Running a successful dental practice requires more than just providing excellent patient care—it also means managing your business in a way that maximizes financial efficiency. One of the most powerful tools available to help you do that is the Section 179 Tax Deduction, a tax benefit designed specifically for small businesses like dental practices. With Section 179, you can save significantly on equipment purchases, allowing you to invest in high-quality dental tools and technology while reducing your tax burden.

What is Section 179?

Section 179 is part of the U.S. tax code that allows businesses to deduct the full purchase price of qualifying equipment and software during the year it’s placed in service, rather than spreading out the depreciation over time. This can result in significant tax savings for your dental practice, particularly when investing in essential equipment that helps your clinic grow and operate efficiently.

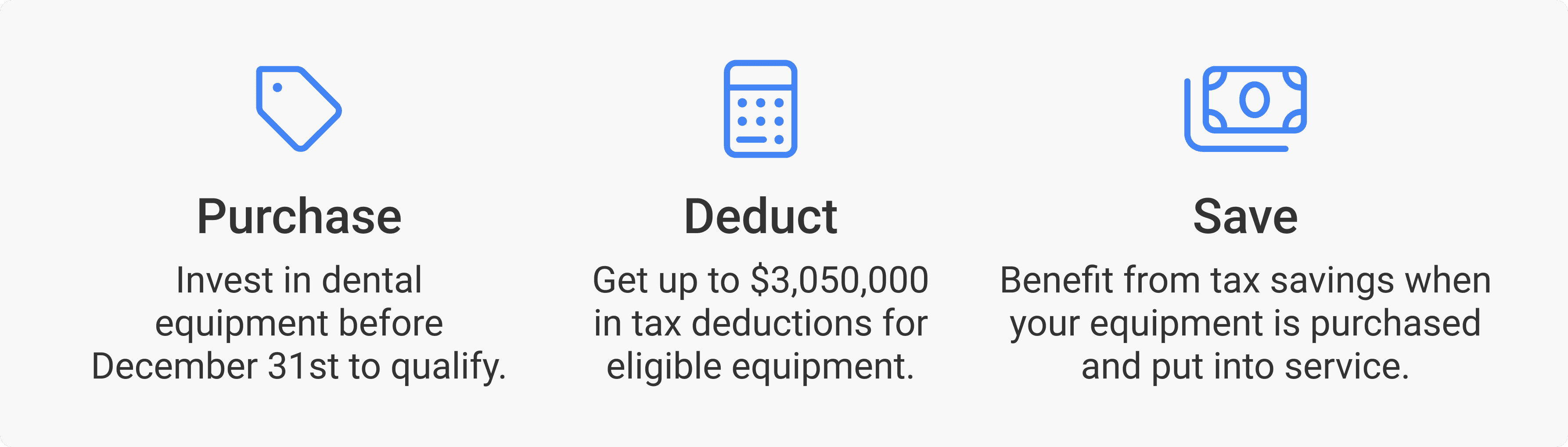

In 2024, dental practices can deduct up to $1,220,000 worth of equipment costs through Section 179, with the total equipment purchase limit set at $3,050,000. This deduction applies to both new and used equipment, making it highly flexible for practices planning to upgrade their tools or expand their services.

Why Section 179 Matters for Dental Practices

Dentistry is a technology-driven field, and keeping your equipment up-to-date is crucial for delivering high-quality patient care and staying competitive. However, new equipment can represent a significant investment. With Section 179, dental practices can ease the financial strain by deducting the entire cost of new or used equipment from their taxable income. This can include:

CAD/CAM systems

Practice management software

By taking advantage of Section 179, dental practices can reinvest their tax savings into further improvements, such as expanding services, upgrading patient care technologies, or even marketing their practice.

How Does Section 179 Work

How Net32 Can Help

At Net32, we understand the importance of maximizing your practice’s financial resources while delivering the highest quality care. Our platform provides dental professionals with access to a wide range of competitively priced equipment, from essential tools to advanced technology. By utilizing Net32 for your equipment needs and taking advantage of Section 179, your practice can save both upfront on purchases and long-term through tax deductions.

Moreover, because Net32 offers significant cost savings compared to traditional suppliers, you can stretch your budget even further. This means that, with the tax savings from Section 179 combined with the savings from Net32’s marketplace, dental professionals can make more impactful upgrades with less financial strain.

Steps to Take Advantage of Section 179

Taking advantage of Section 179 is simple, but it requires proper planning. Here’s a quick guide to get started:

Identify Your Equipment Needs: Assess your dental practice's needs for new or upgraded equipment. Prioritize items that will enhance patient care or improve practice efficiency.

Budget for Your Purchases: Understand the limits of the Section 179 deduction ($1,220,000 in 2024) and plan your purchases accordingly to maximize the benefit.

Buy Before December 31st: For the deduction to apply to your 2024 taxes, the equipment must be purchased and placed in service by December 31st.

Consult with a Tax Professional: While Section 179 is highly beneficial, it’s always smart to work with a tax advisor to ensure you’re taking full advantage of it based on your practice’s financial situation.

Maximize Your Savings Today

With Section 179, dental practices have a tremendous opportunity to reduce their tax liability while investing in the tools needed for long-term success. At Net32, we’re committed to helping you get the best deals on high-quality dental equipment, allowing you to leverage both tax savings and cost efficiency.

Start planning your purchases today and see how you can benefit from Section 179 before the year ends!

Shop the Story

Young Infinity Cordless Hygiene System. Includes: Cordless Handpiece and Pedal

Shop Now

MobileX Portable Handheld X-Ray Generator Kit

Shop Now

Woodpecker US-II LED Ultrasonic Piezo Bone Cutter. Complete set

Shop Now

Goccles Optical Filter Eyewear for Oral Cancer Screening, Single Kit

Shop Now

TurboSENSOR Ultrasonic Scaler, 110V

Shop Now

Classic Pedo Chair - Leather. 3 prepostion touchpad, 2033 Pioneer 3HP delivery

Shop Now

PureWay ECO II + Amalgam Separator (Tandem) for 10-20 Chairs

Shop Now

Polaroid Wired HD Intraoral Camera

Shop Now